- By:

- Category: Labor

JOURNAL PUBLICATION: Unemployment Insurance (UI) Benefit Generosity and Labor Supply from 2002 to 2020: Evidence from California UI Records (Published in April 2024 issue of the Journal of Labor Economics)

NBER WORKING PAPER: UI Benefit Generosity and Labor Supply from 2002-2020

Prepublication version ![]()

PRESS RELEASE: New Study in the Journal of Labor Economics Shows how Workers Respond to More Generous Unemployment Insurance Benefits

This study examines the link between unemployment insurance (UI) benefit amounts and how long people remain out of work. Unlike most previous research, this new study looks at how that relationship changes during recessions — including during the COVID-19 pandemic. It was featured in the April 2024 issue of the Journal of Labor Economics.

Typically, policymakers consider providing more generous unemployment benefits during recessions. Prior studies have analyzed the effects of increases in weekly benefit amounts on the length of time claimants remain unemployed. But policymakers may also want to know how this response to benefit generosity varies over the business cycle, and what, if anything, changes in worker’s behavior.

Our research strategy allows us to isolate this response for each year from 2002 to 2020. We then assess how the effect differs in different economic conditions – including the Great Recession, the following economic expansion, and the COVID-19 pandemic.

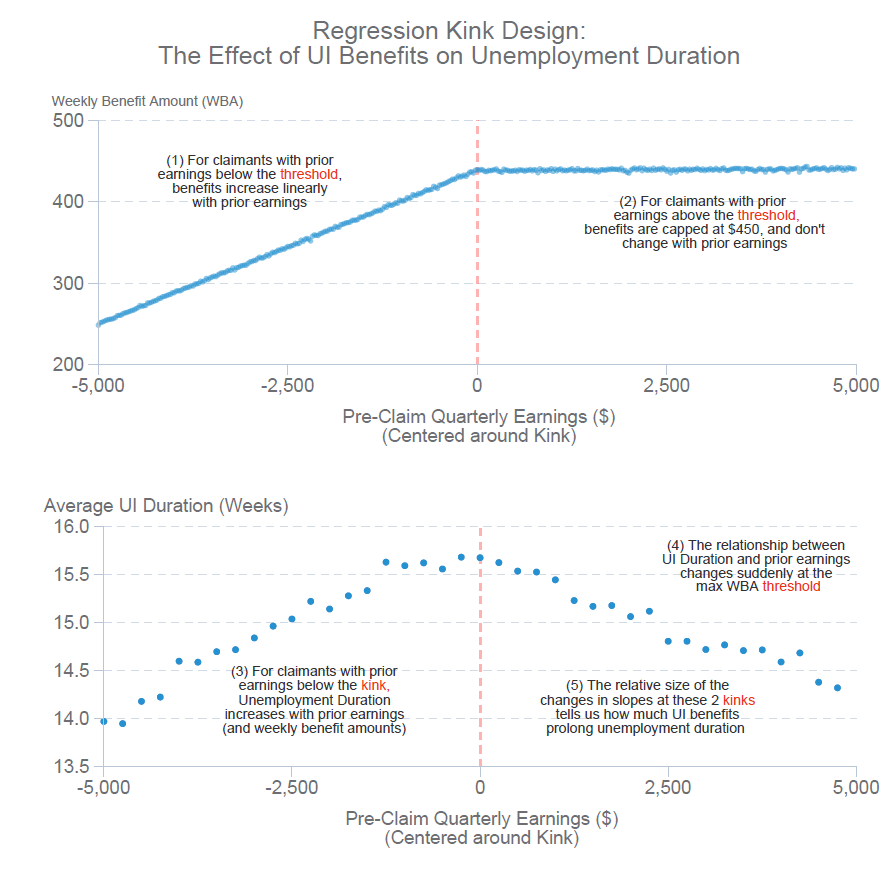

To obtain an estimate of the effect of increased UI benefits among UI claimants for any given year, we use the fact that the UI benefit schedule replaces a constant fraction of prior earnings up to a maximum benefit amount, at which point the benefit schedule has an abrupt change in slope—or “kink”. This approach has been increasingly used by economists to estimate causal impacts when a true randomized experiment is infeasible.

How does this work? We first measure the change in the slope of the benefit schedule at this kink point (Benefits first increase at a rate of 50% of prior earnings, then, once claimants reach the max WBA, benefits are constant.) Next, we measure a similar relationship between unemployment duration and prior earnings. If we observe a sudden change in this relationship at the same kink point that exists in the benefit schedule, we infer that the change in the benefit schedule caused this second kink. By comparing the relative size of these two kinks, we can estimate the causal effect of weekly benefits on unemployment duration.

Our research design yields three key findings about the effect of weekly UI benefit generosity on job search:

1) The effect of UI benefit generosity on claimants’ behavior at any given point in time while they are claiming UI benefits does not vary with the business cycle. When weekly benefit amounts are higher, claimants are less likely to choose to stop receiving the benefits at any point in their unemployment spell, but this effect does not vary with labor market conditions.

A common way to measure workers’ responsiveness to UI benefit generosity is the share of workers who claim benefits for longer than a set number of weeks, which is known as the survival rate. When UI benefits are more generous, survival rates tend to increase, regardless of how long a person has been claiming UI benefits. However, this new research shows that the effect UI benefits have on these survival rates does not appear to change during recessions or economic expansions. For example, the researchers estimated that increasing weekly UI benefit amounts by 1% caused the 10-week survival rate (the share of workers still receiving UI benefits 10 weeks after they first signed up for unemployment) to increase by about .45%. This effect was consistent in every year between 2012 and 2019, despite the fact that the unemployment rate declined by 50% during that same time period. In other words, the effect of UI benefit amounts on survival rates doesn’t seem to change, regardless of what point in the business cycle (expansion, recession, etc) a person is claiming UI.

2) In contrast, the effect of UI benefit generosity on total unemployment duration was higher during the Great Recession than in the surrounding years, when unemployment rates were lower and benefit extension programs were not in effect. The increase in the responsiveness to weekly UI benefit generosity during the Great Recession was driven by increases in potential benefit duration (UI extension programs), which mechanically increase total duration elasticities to benefit levels through what we refer to as a “coverage effect.”

3) During the pandemic, the amount of weekly UI benefits mattered substantially less to the behavior of claimants than at any point in the previous 20 years. This decline in the response to UI benefits during the pandemic was not driven by changes in the composition of UI claimants, but instead appears to have been a result of other unique factors of the pandemic environment, including increases in liquidity and risks associated with returning to work, among other things.

These findings can help inform policies related to unemployment insurance benefits in future economic downturns, including questions around benefit levels and extensions, and the role that supplemental federal programs played during the COVID-19 Pandemic.