Background: The COVID-19 crisis has led to historically unprecedented increases in the level of initial Unemployment Insurance (UI) claims filed in California since the start of the crisis in mid-March. Through a partnership with the Labor Market Information Division of the California Employment Development Department, the California Policy Lab is analyzing daily initial UI claims to provide an in-depth and near real-time look at how the COVID-19 crisis is impacting various industries, regions, counties, and types of workers throughout California.

The Policy Briefs are updated on a monthly basis.

Return to the main report page to see all of the policy briefs, data points, and media coverage.

June 11th Policy Brief

By

REPORT: June 11th Analysis of Unemployment Insurance Claims in California During the COVID-19 Pandemic ![]()

PRESS RELEASE: New Analysis: California UI Claimants Began Returning to Work, and More UI Claims Are Being Reduced or Denied as a Result

Key Research Findings

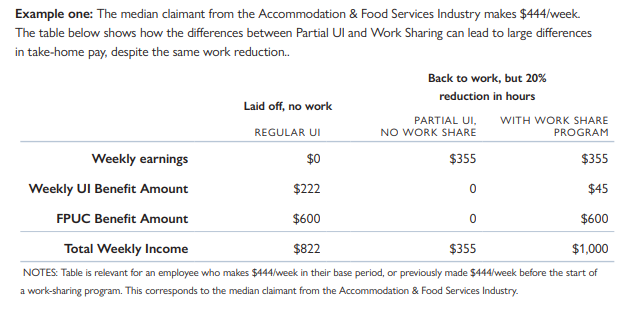

1. In a sign of improving economic conditions, the fraction of UI beneficiaries either not receiving their first benefit payment because their earnings were too high or receiving partial UI benefits increased in the first half of May. Only workers earning less than three quarters of their prior weekly wages qualify for partial UI and FPUC (and workers earning above that are denied UI benefits entirely for that week), creating a difficult decision for workers in an uncertain labor market.

2. In the weeks preceding May 16th, the period preceding last week’s Jobs Report, a total of 0.46% of the California labor force in April either received partial UI or were denied benefits because of excess earnings (compared to a one and a half decline in the national unemployment rate). Hence, a substantial fraction of individuals that recently returned to work are working reduced hours and may still be attached to the Unemployment Insurance system.

3. As layoffs become more evenly distributed across industries, the share of UI claims by more educated workers have been gradually increasing. Among higher educated workers that claimed benefits recently, Generation Z (age 16-23), women, and those working in Health Care and Social Assistance were most affected.

4. During the past four weeks, about 70% of initial UI claimants reported that they expected to be recalled. However, differences in recall expectations are growing, with 62% of Black workers who filed claims from May 17th to May 30th saying they expect to be recalled vs. 72% of White, 73% of Hispanic, and 74% of Asian workers.

5. The cumulative impact of the crisis is still substantially greater for less advantaged workers – over 1 in 4 women (as opposed to 1 in 5 men), more than 1 in 3 members of Generation Z, and more than 1 in 2 workers with a high school degree have filed for benefits.

6. As the economy slowly re-opens, programs such as Work Sharing, which allow working claimants to keep a share of their UI benefits and maintain eligibility for the $600 FPUC payment, would help strengthen the financial outlook for workers if they’re working at reduced time and earnings.