- By:

- Category:

Sacramento, June 11, 2020— A new analysis of Unemployment Insurance (UI) claims in California by the California Policy Lab at UCLA and the Labor Market Information Division at the California Employment Development Department finds that an increasing share of UI claimants are returning to work and seeing their UI benefits either reduced or denied as a result. Our findings indicate that a substantial fraction of the recent increase in employment may be from workers still attached to the UI system. While the share of more educated workers claiming unemployment is growing, the analysis also finds that the least advantaged workers continue to be the most impacted, including Californians with less education (one in two workers with a high school degree have filed for unemployment), over one in four women, younger people (more than one in three of Generation Z), and the nearly one in three Asian and Black workers who have filed for unemployment.

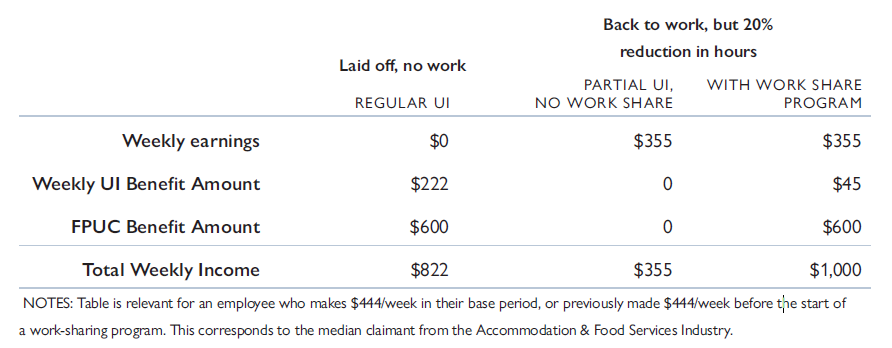

“The reductions in UI benefit amounts and denial of benefits are another real-time way to measure how our economy is slowly recovering, and while on its face it appears positive, it’s also important to look at how this impacts workers,” explains Till von Wachter, a co-author of the analysis, UCLA economics professor and faculty director at the California Policy Lab. “It seems counterintuitive, but if you’re returning to work, especially at reduced hours, those earnings could result in you not receiving even partial UI benefits, which also means you lose the $600 FPUC payment from the CARES Act. For a low-wage worker, the net result may be dramatically lower weekly income, and that’s a costly decision to make, to say nothing of ongoing safety or childcare concerns.”

New in this analysis: This policy brief focuses on which claims for UI have been paid during the COVID-19 crisis, and an increase in the number of claimants whose UI benefits are being either reduced or denied altogether because of their earnings. While this is a positive indicator for the overall economic outlook, our analysis also highlights how programs like Work Sharing could significantly cushion the economic impact for workers who are recalled to work at reduced levels.

Key research findings:

• In a sign of improving economic conditions, the fraction of UI beneficiaries not receiving their first benefit payment because their earnings were too high in the relevant week increased to about 13% in mid-May. At its lowest point during the crisis this fraction was 5%, compared to 10% at the start of the crisis.

• In a further sign of improving conditions, the fraction of UI beneficiaries receiving partial UI benefits (and thus reporting at least some hours worked during the week) in their first payment rose to 10-13% in mid-May. This fraction rose to 20% at the peak of the crisis in mid-March and fell to just above 5% by the end of April when employers favored layoffs to keeping workers on a part-time basis.

• In the four weeks preceding May 16th, the period preceding last week’s Jobs Report, a total of 86,000 claims (or 0.46% of the California labor force in April) either received partial UI or were denied benefits because of excess earnings. Hence, a substantial fraction of individuals that recently returned to work are working reduced hours and may still be attached to the Unemployment Insurance system.

• As of May 30th, about 80% of new initial UI claims since the start of the crisis were processed and found eligible for their first benefit payment. The median time from claim filing to first payment for initial claims was about two weeks throughout the crisis.

• As layoffs spread to other industries, the share of UI claims by more educated workers have been gradually increasing. Among higher educated workers that claimed benefits recently, Generation Z (age 16-23), women, and those working in Health Care and Social Assistance were most affected.

• The cumulative impact of the crisis is still substantially greater for less advantaged workers – over 1 in 4 women (as opposed to 1 in 5 men), more than 1 in 3 members of Generation Z, and more than 1 in 2 workers with a high school degree have filed for benefits.

• During the past four weeks, about 70% of initial UI claimants reported that they expected to be recalled. However, differences in recall expectations are growing, with 62% of Black workers who filed claims from May 17th to May 30th saying they expect to be recalled vs. 72% of White, 73% of Hispanic, and 74% of Asian workers.

• As the economy slowly re-opens, programs such as Work Sharing, which allow working claimants to keep a share of their UI benefits and maintain eligibility for the $600 FPUC payment, would help strengthen the financial outlook for workers if they’re working at reduced time and earnings.

Work Sharing Example: This chart shows the financial impacts of returning to work, using $444 a week that the median Accommodation & Food Services Industry worker was making before the crisis. If they returned to work, with a 20% reduction in hours, their reduced earnings of $355 would still put them over the threshold for receiving partial unemployment insurance.

Methodology

The analysis is based on comparing initial unemployment insurance claims in February 2020 (before the COVID-19 crisis impacted the labor markets); the start of the employment crisis in mid-March (when initial UI claims increased dramatically); and more recently the first 25 days of April.

The analysis complements traditional survey-based indicators on the labor market, which have detailed information but large time lags and lower frequently, and to weekly publications of the number of total UI claims, which have minimal time lags but which lack the detail available in this analysis.

This analysis will be updated on a regular basis with new data on initial Unemployment Insurance claims to provide a timely and detailed analysis of the impacts of COVID-19 on California’s labor market.

###

The California Policy Lab creates data-driven insights for the public good. Our mission is to partner with California’s state and local governments to generate scientific evidence that solves California’s most urgent problems, including homelessness, poverty, crime, and education inequality. We facilitate close working partnerships between policymakers and researchers at the University of California to help evaluate and improve public programs through empirical research and technical assistance.

The Labor Market Information Division (LMID) is the official source for California Labor Market Information. The LMID promotes California’s economic health by providing information to help people understand California’s economy and make informed labor market choices. We collect, analyze, and publish statistical data and reports on California’s labor force, industries, occupations, employment projections, wages and other important labor market and economic data.